2025-2026 budget analysis: The government borrows to pay off debts and Interests are up to 87% of tax revenue

Press Release

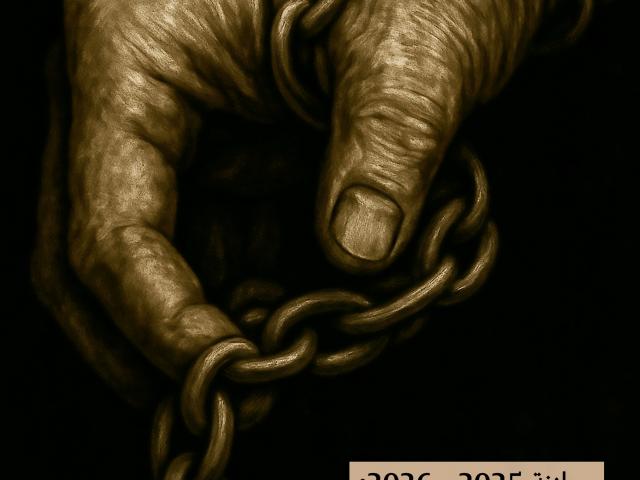

The Egyptian Initiative for Personal Rights (EIPR) released an analytical paper titled "The 2025-2026 Budget: Egypt in the Grip of Debts", providing an analysis of the public budget of the fiscal year that began in early July.

The budget that was approved by the parliament on the 17th of June after just one day of discussions, is supposed to address a situation where the living standards of Egyptians continue to decline as a result of a series of economic decisions and austerity policies pursued by the government. These policies aimed at reducing public spending, by liberalizing the prices of a number of goods and services, including fuel, electricity, food, drinking water, medicine and health services, and they caused successive waves of price hikes. However, public spending increases year after year, albeit mostly directed to debt servicing.

Egypt increasingly relies on internal and external debt to provide resources, which clearly affects the composition of the new fiscal year's budget, in which debt and interest repayment obligations swallow up about two-thirds of the government's planned spending. The main way for the state to obtain new resources to bridge the gap between revenues and expenditures is to obtain new loans, a predicament that is likely to continue and worsen for years to come.

Despite the government's announcement of its intent to reduce external debt, the 2025-2026 budget depends on an increase in external borrowing by 186% compared to the previous year’s budget.

Austerity continues to be a dominant feature of the new budget, as spending on subsidized petroleum products falls to less than half of the allocations set for the fiscal year that is about to end, indicating further fuel price hikes, after already increasing fuel prices three times in 2024 and then a fourth time in April 2025.These cuts are part of the government's pledges to the IMF to cut spending on subsidies, with all the consequent increases in the prices of goods and services that rely on transportation or the use of fuel. Spending on education and health as a percentage of GDP also continued to decline, and the increase in food subsidies was less than the inflation rates, leading to a decline in real spending on this item. Meanwhile, Takaful and Karama pension allocations increased, although they remain below poverty limit estimates.

As for resources, the new budget continues to rely on payroll taxes and taxes on the consumption of goods and services, making up 45% of its expected revenue, compared to only 12.5% funded by taxes on corporate profits, and 0.7% contributed by real estate owners.

Domestic and foreign debt interest amounts to about 87% of the tax revenues expected in the new fiscal year. This means that taxpayers are in fact financing the profits of state lenders, namely banks, individuals and institutions at home and abroad.

The new year's budget witnessed some developments in line with Egypt's pledges to the IMF in this regard. The government set a public debt ceiling of 94.3% of GDP in June 2025, to drop to 90% by the end of the new fiscal year in June 2026. This is a positive step and responds to demands that have been raised by human rights and economic organizations for years. However, the debt ceiling is still very high as a percentage of GDP, which requires the development of a different vision of economic policies in order to reduce it.

In its presentation of the financial statement, the Ministry of Finance said the government intends to develop a medium-term budget for three years, and that the ministries will present their four-year budgets, providing no further details in this regard. This can help develop the planning process, but it can also create a restriction on expenditures that some sectors may need. The success of medium-term planning requires involving various sectors in the planning process, on a wide scale, so that financial plans become truly compatible with needs, based on a broader vision of economic recovery and the provision of economic and social rights to the population.

Transparency of the new budget has slightly improved compared to the previous year, particularly regarding the relationship between the general public government budget and that of economic authorities, with the data presented in a more organized manner. However, the government did not adhere to the unified budget it promised, and only included some data on economic bodies, without unifying the budget being the basis of its various sections.

EIPR’s policy paper that was published in Arabic before the parliamentary budgetary deliberations began raised some points intended to guide a constructive policy discussion of the Egyptian public budget:

** In order to free the state budget from debt captivity, there needs to be a clear plan to reduce dependence on borrowing as a primary source of revenue.This requires a serious approach to encourage the productive and service sectors that generate income and added value, and to restructure tax policies to become fairer and more efficient, so that the profiteers bear their share of taxes instead of over-burdening workers and average consumers with the greatest tax share. External borrowing should be also reduced for necessary considerations that the parliament must contribute to identifying.

** The parliament must participate in setting the debt ceiling, and ensure that this ceiling is completely inclusive of not only the budget bodies, but also the economic bodies and the central bank.

** The parliament must have a role in setting the priorities for the spending of borrowed funds, rather than the current situation in which the government alone takes over this task without popular oversight, when it was the government acting alone that caused the debt crisis. The parliament’s oversight over new borrowing deals should be increased, by quickly presenting the details of said deals, as well as clear statements regarding loans from economic bodies, to the house of representatives. The parliament should also oversee the central bank's foreign loans through foreign deposits and consider their financial and non-financial conditions.

On the expenditure side, there is a need to schedule debts and extend their current low average repayment maturities, in order to reduce the burden on the budget and allow a wider margin for spending on various aspects of human and economic development, while placing restrictions on spending on projects that do not contribute to generating income, reducing future expenditures, or meeting the basic needs of the population (such as the development of education, health, housing and decent job opportunities).

** Spending on health and education should be increased immediately to meet the constitutional stipulations, given their crucial importance in development and in filling the gap of social inequality, especially in light of the shortage of health service providers and teachers.

** There is generally a need to review the logic of the government subsidy policies, as they seem to lack the correct social and human rights direction. State subsidies for basic goods and services, such as supply, social security, medical treatment and energy, are supposed to aim to guarantee the economic and social rights of citizens, as holders of the right to public funds, in addition to compensating them for the lack of public services, lack of jobs and low wages due to the economic policies in place. Therefore, the state subsidy should be expanded in light of the current deterioration in living standards. This is different from subsidizing the important productive and service sectors that benefit the economy but also target profit. Therefore, the state subsidy for these sectors must have conditions related to their contribution to job creation, increasing production and tax compliance, while reviewing the role of this subsidy periodically, and lifting it if it does not achieve its goal, because the state's goal is not just to help the profiteers increase their profits.